Investment Cage Match: Private Equity vs Venture Capital vs ... ?

...why we need a third class of investors

Let me preface this article with the statement that this is a very deep and complex topic and I am taking some liberties in stereotypes and generalizations. There are sections to every rule and I’m sure you can find cases what refute my statements here. So take what I say with a grain of salt and realize that it’s an average of my and others’ experiences. Your mileage my vary.

In the world of investing there are two major players. Venture Capital and Private Equity. While there are individual investors, angel investors, banks, strategic partners and more, the two aforementioned investment styles are the two most popular in the US outside of the public markets. Let’s take a look at the pros and cons of each and why I believe it’s time for a third model.

What is Private Equity

Private Equity is a type of investment where firms or investors buy shares (or all the shares) in companies that aren't listed on public stock exchanges. They often focus on companies that need a bit of a boost to grow or that might be struggling and could do with some restructuring to get back on track.

Private equity investors usually plan to make changes to improve the company's value over a few years, and then they aim to sell their shares for a profit usually in 3-10 years.

PE’s tend to analyze a company’s financials much closer than their VC counterparts and often will not invest in non-profitable firms. EBITDA is the all important factor to PEs. They will spend 100s of hours in due diligence looking for any red flags

What is Venture Capital

Venture Capital, or VC for short, is providing funds to startups that show a promise and could potentially bring in big returns on investments. It's not just wealthy individuals who get involved, but also investment banks and firms that specialize in helping startups grow. These investors typically make large bets on risky companies with the hopes that one of them will become the next “unicorn” like Uber or Google.

VCs favor small companies in an early phase. While this is the riskiest stage of any company it is also the point that can provide the highest returns.

VCs tend to focus more on the potential future growth and outcomes rather than current performance. In fact most VC supported companies are unprofitable or are even pre-revenue.

How do VCs vs PEs Make Money?

Both VCs and PEs use other people’s money to make these investment. They create a pool of money called a “fund” that is collected from multiple high net worth individuals or compines and pooled together. The VC/PE firm then deploys this money to invest in companies. For their work they ted to collect both management fees (2-3% of the fund per year.. e.g. on a $200M fund they will collect $4M a year as “management fees” regardless of the outcome of the investment). Both also typically get what is called “carry” (short for carried interest).

It's a way of sharing the profits that goes beyond just getting back your initial investment. Here's how it typically works:

The people who manage the fund, often called the general partners (GPs) in addition to the management fee also earn shares of any profits made from the investments. That share of the profits is what's called the carry.

The carry is usually about 20% of the fund's profits, but it kicks in only after the fund has returned the original investment amounts to the investors (this threshold is sometimes called a "hurdle"). So, if the fund does well and makes a lot of money, the GPs get a significant chunk of the profits as carry, as a reward for their successful management and investment choices.

However if the fund does poorly the firm still makes their management fee. Which as we have seen can be substantial. Now a PE/VC firm that fails often can earn a black eye. However there are no legal requirements to disclose how you did on a fund. So, that being said, there is really no way to know for sure how “good” these investors really are.

So how much do they make?

Obviously this varies from fund to fund and investment to investment. However we can look at some averages to get an idea.

Venture Capital as compared to the S&P 500 (had you just invested in a market index), returned and average annual return (AAR) of 17.2%, compared to the S&P 500’s AAR of 13.9% over the last 10 years.

Meanwhile Private Equity over the last decade retuned 13.7% while the S&P 500 earned 13.9%. Not stellar but when you look over the last 20 years PE does edge out the S&P slightly.

So at first glance it seems obvious. I’m putting all my money in VC!

Not so fast there Gordon Gekko!

While VC does have a higher average return these results are very skewed. It’s like taking 10 people (including Jeff Bezos) and saying the average net worth of these 10 people is $5B dollars. That one person skews the results quite a bit.

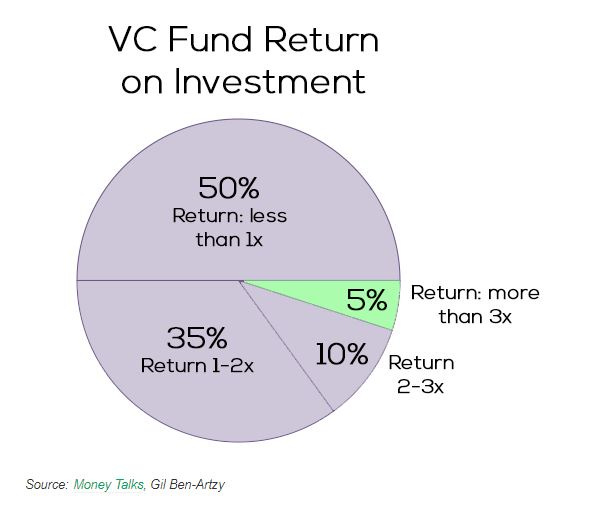

The chart below shows the real outcomes of most VC investments.

So as you can see more than half of all VC investment return less than 1x. Which means that a flip of the coin decides if you make money or lose money. So while a majority of the investments go to near zero there are some big winners.

Meanwhile in the PE the numbers are a bit harder to find since they are, by definition, “private”. However overall the numbers tend to hover around the 13% averages as discussed above. There are rarely any investments that go to zero just as rare as they 10x.

Generally put, PE is a slow and steady, somewhat reliable investment while VC is the high risk, high reward “gambling” in the investment world.

How do they differ?

Please keep in mind this next section is my editorial opinion.

Simply put (generally and stereotypically) VCs are emotional and impulsive creatures. They will invest into things that no rational or sane person would invest in simply because it strikes their fancy. This is not to say they don’t do research but in my experience they make some really DUMB decisions that any rational and logical investor would not make. They will write checks for multiple millions of dollars on nothing more than a recommendation of a friend or a 10 page powerpoint.

I routinely shake my head at some of the series A and B rounds I see in our industry.

It’s like watching a person put $50M on a single spot in Roulette. You know with pretty good certainty they are losing that money. However, on the off chance that one spot hits, they can also walk away with a massive payday.

Jason Calacanis famously invested $25,000 in Uber in 2007 when the company was valued at $5 million. His investment is now worth around $100 million. Not a bad payday. But for every big win like this there are 100s of losses.

They also help to fund innovation in our world. Without these massive investments we likely would not have companies like AirBNB, Uber, Twitter (the original, not X).

(True story: I was asked to vet a pitch deck for a startup. The VC was ready to stroke a check for $20M. I reviewed it and explained why it would never scale (I had hard facts to support my opinion). The VC had no idea about the market and legal issues and ultimately did not invest. When I asked them for 1% for the savings I earned them I was laughed at…)

PEs meanwhile are the logical and conservative bunch. They want to study numbers. Their main metric is EBIDTA on which (using a multiple) they often base the price they are willing to pay for a company (industries do differ, some use revenue, others EBIDTA).

They want to see a solid company with potential for growth. However beyond the initial purchase they will often not put in too much in additional capital. They want to use debt financing and other similar instruments to allow the company to grow the bottom line through increased sales, efficiencies and/or further acquisitions. While a PE firm often owns multiple companies it is my experience that many do a poor job of combining back office functions (such as finance, HR, purchasing etc..) to have a 1+1=3 effect on the business.

While not all PE firms are the same, many have gotten a bad name as being “cost cutting” firms that come in and cut expenses and staff to better the bottom line. This often changes the culture of a business and while this is a short term gain, it’s often a long term loss.

So you mentioned a third option…?

So we’ve seen the pros and cons and differences in style of VC and PE. We’ve discussed the up and down sides. They sit at two different ends of the spectrum in terms of risk and rewards and emotion and logic.

So why not combine the best of both worlds?

Some would call this strategy "growth equity" or "growth capital" (terms I did not invent). But it’s not widely popular.

Essentially I believe that both investors and the targets they acquire would be better served by finding good, solid companies with proven profitability and investing money into their continued growth. While some would argue that is what PE does I would say it’s not. In my experience the PE firms are reluctant to invest much more beyond the purchase price.

Take for example a well run, profitable $20-25M automation company. Perhaps they have a good leadership team and a semi standard product (or the ability to develop one). Perhaps they don’t have a good financial system or MRP system Or they are lacking the ability to take advantage of service income because of a lack of labor.

Free idea that I should probably keep to myself: Find a production CNC shop (not a job shop) and FULLY automate every single aspect possible. Robots loading and unloading the machines 24/7. You could run a sizable shop with a programmer, a person who prepares blanks and a person who runs the robots.

With an investment of just a few million dollars, strategically earmarked for specific projects, these companies could grow 20% or more YOY for multiple years.

Add in money earmarked for R&D, standardization of products, new prototypes (all very VC-ish ideas) and you could make this growth rate even higher.

Essentially invest in a company’s strengths and fuel that growth with money while tempering your investment to things are are likely possible and scalable and not moonshots (cough…humanoid robots.. cough).

I know that given the option between a small chance of a 1000x return and a large change of a 5-10x return I’ll take the latter anyday.

But what do I know..

But hey, I’m not a VC or PE. I’m simply a business owner and investor that has had enough exposure to both sides to see that there might be room for another option.

One last point: In both forms of investing there is one underlying theme I have found to be true. In many cases both VCs and PEs do not understand the business they are investing in or buying. They are great a handling money and finances but not as good at operational and technical decisions.

Interesting enough in my talks with many investors they tends to agree. There is room for a third option.

I’ve often thought that I should put my money where my mouth is and partner with a finance expert and open my own investment firm. We’d focus on this third option of investing. So if you share my views and want to discuss opportunities please reach out.

The Automation Navigator is brought to you by Automation AMA, a company founded and run by an industry leader in assembly, robotics and packaging. Automation AMA offers a variety of services to help you on your automation journey or to help fine tune your engineering, sales, operations and business development departments. Learn more at www.automationAMA.com or shoot me an introductory email.