Trump Tariff Analysis

This is a bit different than most of my other articles. This is a repost of one of my LinkedIN posts that has gone semi viral (with a few additions and updates)

Original LinkedIn Post

Some people will just see this as another Trump bashing post but it's not that. It's clearing up the misinformation that this administration is feeding the US people. And it's about economics, something that effects each and every one of us and our companies. Especially in manufacturing.

We have all see the chart showing how these countries are charging us theses INCREDIBLY high tariffs. Well my friends those numbers are WRONG.

If you notice in the first column there is some fine print that states it's tariffs "including currency manipulation and trade barriers." OK so what does that mean?

Well it's murky but by their own admission the White House not only looks at the base tariffs but also the "trade imbalance". So let's look at the EU. The average base tariff is 2.7%. That's right, less than 3%

On his chart it shows 39%.

That's because we import about 39% more to the EU than we export. We can go into reasons why (many have to do with the hormones and other crap we put in our foods that the EU does not want...). But the bottom line is Americans want EU products so they buy them.

Even the White House itself admits this is the calculation they used. It’s the trade deficit expressed in terms of %. A completely different number than the true tariffs imposed.

Same with Japan and other Asian countries. Vietnam is listed at 90% tariffs. In reality it is 9.7%. The other 80% is from a trade imbalance. Why? Because we buy a ton of cheap clothes from Vietnam and Vietnam is too poor to afford most of our goods. So of COURSE there will be a trade imbalance.

And this is not something you can fix with tariffs. There are rich countries, poor countries, countries that choose to do business with us, and those that do not. Sometimes, there are products that you can only get from one area of the world. You can’t magically level the playing field by imposing these fees.

So by displaying this chart (with the “fine print” that 95% of Americans do not understand), they are essentially lying to us all to make us feel “outraged” at how badly the world is treating us.

In fact, it’s been theorized that the White House used AI to generate the country list based on internal Top-Level Domains (TLDs), as it includes places like Heard and McDonald Islands, which are uninhabited except by penguins (and boy, are they upset). Further oddities include Gibraltar, which is part of the UK, and Réunion (located in the Indian Ocean), which is part of France. Both of these areas have next to no trade with the US.

Prices for almost everything are going to go up in the US. Even things that are made here often have components that are made outside the US.

He put a 25% tariff on steel and aluminum. We have less than 100 steel foundries in the US and 4 AL smelters and both industries have been in decline for the last few decades. China has been priced out of the steel industry because they ALREADY have a 25% tariff on steel sold to the US.

Some will argue, well then that will bring back the US steel industry. And yeah, long term it might. But we're talking YEARS AND YEARS easily to ramp up production and new factores. Manufacturing is a SLOW moving industry.

I don't have a big issue with reciprocal tariffs when they are truly that. EU charges 2.7%, fine, we charge 2.7%. But 39%? Come on.

Edit to add a few days after that post (4/7/25):

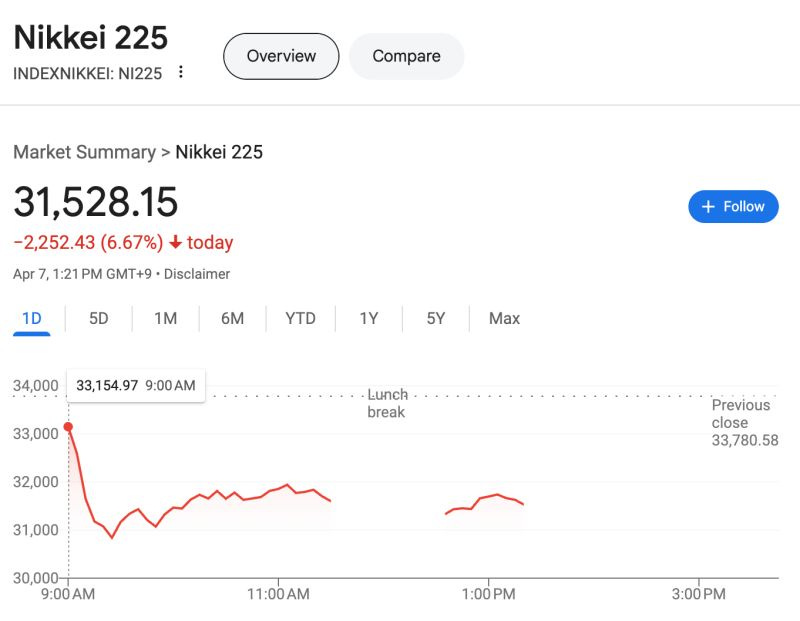

As I work late in the evening (I'm a night owl) I get a notification that the Nikkei 225 index has tripped the "circuit breaker" which is triggered by massive fluctuations in the markets. The Nikkei fell almost 8% and trading was paused for 10 minutes. Which doesn't seem like much but allows the automatic trades to pause long enough for the markets to stabilize.

But the damage is done. Other eastern markets (like Australia and India) also saw large drops.

My prediction is Monday (well today when the markets open) we will see a VERY large drop in the US markets. Perhaps triggering a pause in trading as well.

At this point (as an individual investor) not much to do but ride it out (or place a bunch of short positions), but if the markets continue to fall or even remain at subdued levels you will see most manufacturers pause any major spending and investments in cap-ex and you'll start to see preemptive layoffs and RIFs.

The Automation Navigator is brought to you by Automation AMA, a company founded and run by an industry leader in assembly, robotics and packaging. Automation AMA offers a variety of services to help you on your automation journey or to help fine tune your engineering, sales, operations and business development departments. Learn more at www.automationAMA.com or shoot me an introductory email.